PM Awas Yojana Loan Scheme MIG Interest Rates & Subsidy: Pradhan Mantri Awas Yojana home loan scheme 2021 for middle income group (MIG) has been announced by the central government. The government has now included middle income group under the credit linked subsidy component of the scheme to provide interest subsidy on the housing loans. Under the scheme, the monthly installment for the housing loans taken will come down by Rs. 2000. The government has introduced two MIG categories, MIG-1 and MIG-2 under the new loan scheme.

Persons who have taken/applied for housing loan on or after January 1st 2017 would be eligible to take benefits of up to Rs. 2.35 Lakh under the scheme. Under the new PMAY home loan scheme for MIG, urban families with household income of up to Rs. 18 lakh per annum would be able to take benefits of the scheme. The government has signed MoU with 70 lending institutions for providing home loans to beneficiaries under CLSS for MIG.

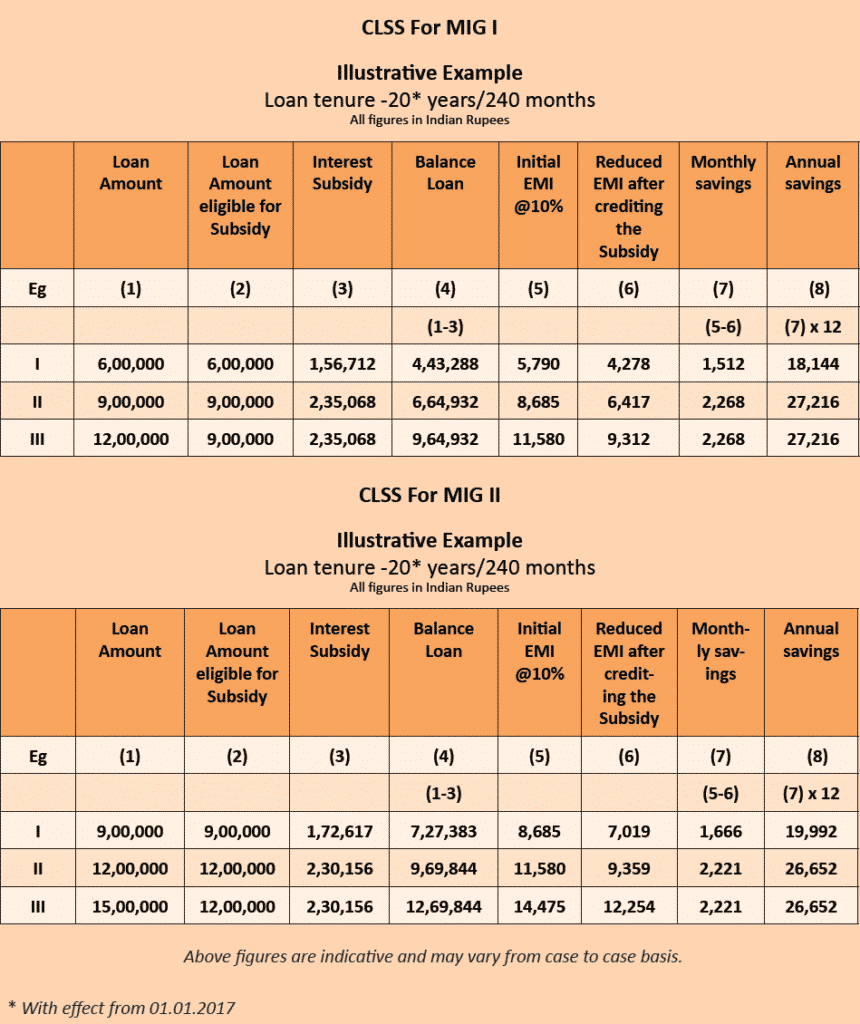

PM Awas Yojana Loan Scheme MIG Interest Rates, Subsidy & EMI

You can now check the PM Awas Yojana Loan Scheme MIG Interest Rates in the table below:-

| Particulars | MIG – 1 | MIG – 2 |

|---|---|---|

| Household income per annum | 12 Lakh | 18 Lakh |

| Interest Subsidy (per annum) | 4% | 3% |

| Maximum loan tenure in years | 20 | 20 |

| Eligible loan amount for interest subsidy under CLSS for MIG | 9 Lakh | 12 Lakh |

| Discount rate for Net Present Value (9%) calculation of interest subsidy | 9% | 9% |

| Maximum interest subsidy | 2.35 Lakh | 2.3 Lakh |

| Dwelling unit carpet area upto | 160 Sq. Mt. (Previously 120 sq.m) | 200 Sq. Mt. (Previously 150 sq.m) |

| Monthly EMI @ 8.65% without interest subsidy | Rs. 7,894 | Rs. 10,528 |

| Monthly EMI @ 8.65% with interest subsidy | Rs. 5,834 | Rs. 8,509 |

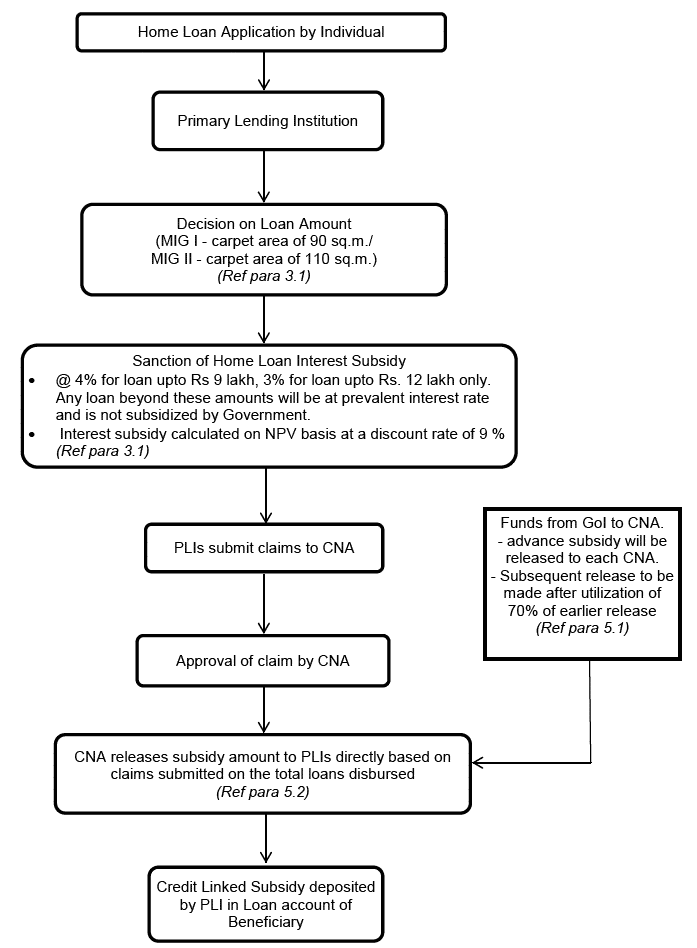

The total interest subsidy accruing on these loan amounts will be paid to the loan account of beneficiaries up front in one go there by reducing the burden of Equated Monthly Installment (EMI). Additional loans beyond the aforementioned specified limit, if any, will be at non-subsidized rate. There would be no processing fee charged by the PLI’s for applications under the CLSS. The PM Awas Yojana Loan Scheme MIG Interest Rates will remain applicable for the entire duration of the scheme.

PMAY CLSS for MIG – Eligibility & Guidelines

Apart from the family as comprising of wife, husband and unmarried daughters and sons, single unmarried youth and earning young adults can also apply for the subsidy under the CLSS for MIG loan scheme. Women with overriding preference to widows, single working women, persons belonging to SC/ST, BC, Differently abled and Transgender people would be given preferences for loans under the scheme. To be eligible to interest subsidy under CLSS for MIG:-

- The beneficiary family should not own a pucca house either in his/her name or in the name of any member of his/her family in any part of India.

- A beneficiary family should not have availed of central assistance under any housing scheme from Government of India.

PM Awas Yojana Loan Scheme MIG Interest Rates must be checked once before applying for the PMAY Home Loan Scheme.

Application Procedure & Steps for PMAY Loan for MIG

EMI Calculator – PMAY Loan for MIG

As per the PM Awas Yojana Loan Scheme MIG Interest Rates, the EMI will be as follows:-

The government has also increased the loan tenure of the CLSS for EWS/LIG from 15 years to 20 years.

Features of PMAY Credit Linked Subsidy Scheme for MIG

PM Awas Yojana Loan Scheme MIG Interest Rates and other details about the PMAY MIG Loan Scheme are mentioned here:-

| Details | MIG I | MIG II |

|---|---|---|

| Household Annual Income (Rs.)Min. | 6,00,001 | 12,00,001 |

| Household Annual Income (Rs.)Max. | 12,00,00 | 18,00,000 |

| Income Proof for Claiming Subsidy | Self Declaration | Self Declaration |

| Property Carpet Area (sq.m.) Upto | 160 | 200 |

| Property Location | All Statutory Towns as per Census 2011 and towns notified subsequently | All Statutory Towns as per Census 2011 and towns notified subsequently |

| Applicability of No Pucca House | Yes | Yes |

| Woman Ownership/Co-ownership | No | No |

| Due Diligence Process | As per the process of the Primary Lending Institution | As per the process of the Primary Lending Institution |

| Eligible Loan Amount | As per the policy applied by the Primary Lending Institution | As per the policy applied by the Primary Lending Institution |

| Identity Proof | Aadhaar No. | Aadhaar No. |

| Housing Loan Sanction and Disbursement Period From | 1 January 2017 | 1 January 2017 |

| Loan Amount (Rs.) Min. | 0 | 0 |

| Loan Amount (Rs.) Max. | 9,00,000 | 12,00,00 |

| Loan Tenure (Years) Max. | 20 | 20 |

| Interest Subsidy (% p.a.) | 4.00 | 3.00 |

| Discounted Rate for Net Present Value (NPV) calculation for interest subsidy – NPV Discount Rate (%) | 9.00 | 9.00 |

| Max. Interest Subsidy Amount (Rs.) | 2,35,068 | 2,30,156 |

| Loan Category at the time of crediting the subsidy | Standard Asset | Standard Asset |

| Lumpsum amount paid per sanctioned Housing Loan application in lieu of processing fee (Rs.) | 2,000 | 2,000 |

| Quality of House/Flat Construction | National Building Code, BIS Codes and as per NDMA Guidelines adopted | National Building Code, BIS Codes and as per NDMA Guidelines adopted |

| Approvals for the Building Design | Compulsory | Compulsory |

| Basic Civic Infrastructure (water, sanitation, sewerage, road, electricity etc.) | Compulsory | Compulsory |

| Monitoring and Reporting the Completion of Property Construction | Responsibility of the Primary Lending Institution | Responsibility of the Primary Lending Institution |

| Default Repayment of Loan | Recover and Pay back subsidy to CNA on proportionate basis | Recover and Pay back subsidy to CNA on proportionate basis |

| Data Submission & Accuracy, and Record Keeping & Maintenance | Responsibility of the Primary Lending Institution | Responsibility of the Primary Lending Institution |

PMAY CLSS MIG Loan Scheme Earlier Updates

Along with the PM Awas Yojana Loan Scheme MIG Interest Rates, you can now check some earlier updates about the scheme. Here are some of the updates as released from time to time regarding PMAY CLSS MIG Housing Loan Scheme. ***Language of Writing is as of the update date***.

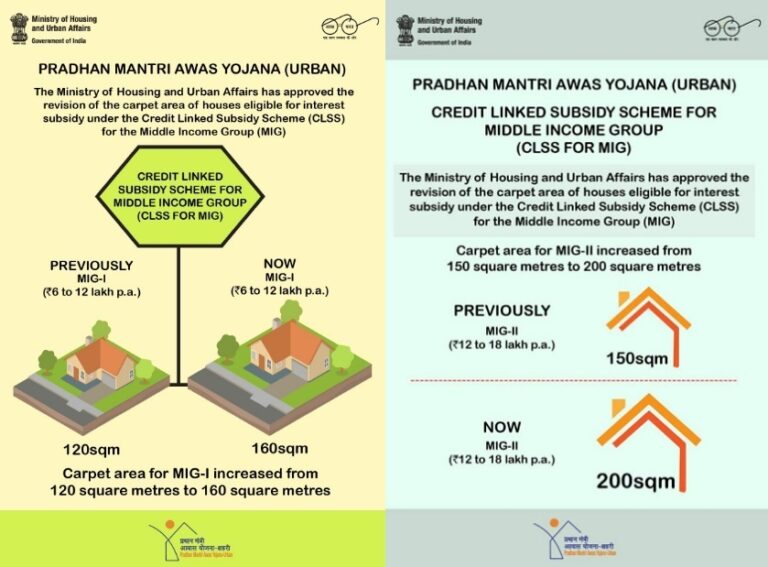

PMAY Urban CLSS MIG – Increase in Carpet Area of Houses Eligible for Interest Subsidy (Update on 12 June 2018)

Ministry of Housing and Urban Affairs (MoHUA) has released a new notification on 12 June 2018 to boost Affordable Housing. This notification is regarding an “Increase in the Carpet Area of Houses Eligible for Home Loan Interest Subsidy under Credit Linked Subsidy Scheme (CLSS) under Pradhan Mantri Awas Yojana (Urban) for the Middle Income Group (MIG)”. Now the Carpet Area under CLSS Component of PMAY-U is increased from 120 square metre to 160 sq.m for MIG I and from 150 sq.m to 200 sq.m for MIG II.

After this decision of increasing the carpet area for housing loan interest subsidy, Construction sector will get a major boost and will lead to enhanced economic activity. Now more MIG people will qualify for Subsidy under PMAY-U. Moreover, this initiative will also work well with the Revised RBI Housing Loan Limits For PSL.

Increase in Carpet Area under PMAY Home Loan Yojana

The important features and highlights of Interest Subsidy under CLSS component of PMAY Home Loan Yojana are as follows:-

- In a major boost to the housing sector, govt. has approved to increase the carpet area for houses eligible for Home Loan Interest Subsidy under CLSS under PMAY-U.

- As a result of this decision, now more MIG customers will qualify for subsidy under Pradhan Mantri Awas Yojana Urban. This would result in enhanced economic activity and construction activities.

- Recently RBI revises housing loan limits for PSL eligibility from Rs. 28 lakh to Rs. 35 lakh in metropolitan areas (with population of 10 lakh or above) and from Rs. 20 lakh to Rs. 25 lakh till the dwelling cost does not exceed Rs. 45 lakh and Rs. 30 lakh respectively.

- Increase in the construction activities in Housing Sector will impact other core sectors like cement, steel, machinery and other allied sectors. Moreover, this move will create jobs for both skilled and unskilled workers.

- For more details on decision of Increase in Carpet Area for MIG Home Loan Interest Subsidy Eligibility under CLSS component of PMAY (U). See Official Notification at http://mohua.gov.in/upload/uploadfiles/files/9029212.pdf

MIG Segment plays a very vital role in the growth and development of economy of the country. CLSS for MIG People will support and help in realizing the dream of every family to own a house of their own.

MIG Home Loan Subsidy Eligibility – PMAY Credit Linked Subsidy Scheme (CLSS)

Here we are describing the MIG Home Loan Subsidy Eligibility under CLSS PMAY-U. The decision to increase the carpet area for MIG section was a long time demand of various stakeholders as potential beneficiaries were denied of the subsidy benefits for their homes due to an enlarge carpet area. Now increase in the carpet area will make them eligible for Interest Subsidy under CLSS. This decision is taken after a large number of requests to increase the carpet areas specified for MIG I and MIG II categories.

PMAY CLSS Home Loan Helpline

The home loans subsidy under CLSS scheme of PMAY will be processed through the Central Nodal Agencies. Below are the contact & helpline details of the CNA’s

National Housing Bank (wholly owned by Reserve Bank of India)

Core 5-A, India Habitat Centre, Lodhi Road, New Delhi 110 003

CLSS Tollfree No: 1800-11-3377; 1800-11-3388

E-mail: clssim@nhb.org.in

Housing and Urban Development Corporation Ltd. (A Govt. of India Enterprise)

Core 7-A, India Habitat Centre, Lodhi Road, New Delhi – 110 003

CLSS Tollfree No: 1800-11-6163

E-Mail: hudconiwas@hudco.org

The assessment applications for PMAY-U are being invited through the online mode through official website pmaymis.gov.in of PM Awas Yojana.

from सरकारी योजना

via

कोई टिप्पणी नहीं:

एक टिप्पणी भेजें

IF YOU HAVE ANY DOUBT PLEASE LET ME KNOW