Launched on 5th April, Stand Up India is a new initiative by the central government of India for the schedule caste, backward tribes & women. It is basically a loan scheme to provide financial assistance to lower sections of the country. The stand up India scheme also promotes entrepreneurship and employment among SC/ST and women.

Main objective of Stand Up India Loan Scheme 2021

The main objective of the scheme is to provide financial aid to SC/ST and women to promote entrepreneurship and employment in the country. The financial aid will be provided to set up and grow businesses to SC/ST and women in need. The initiative will also encourage young minds to come up with innovative ideas and create job opportunities in the country.

At-least one SC or ST borrower and at-least one woman borrower per bank branch for setting up greenfield enterprise. The enterprise may be in manufacturing, services or trading sector. In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC / ST and/ or women entrepreneur.

Amount of Financial Aid in Stand Up India Scheme

The loan amount aid under the Stand Up India Scheme would vary between Rs. 10 lakh to Rs. 1 Crore. The initiative will allow and enable under-served to utilize the institutional credits in the form of bank loans. Under the Stand Up India initiative, RuPay debit cards will be issued to the borrowers to withdraw the money/capital for operations.

The funds allocated under the scheme will help borrowers start their ventures and overall grow the economy of country. Other than the financial aid, the government will also help eliminate the legal and operational hurdles for entrepreneurs under the scheme.

How to Enroll / Apply for Stand Up India Loan

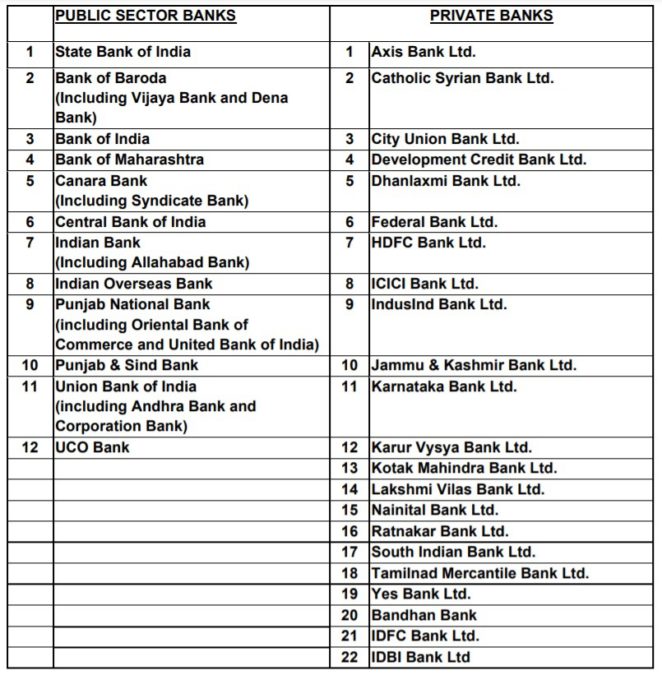

Stand Up India Loan Scheme is operated by all branches of scheduled commercial banks in India. Here is the complete list of banks where applicants can directly apply at banks.

Central government has even launched a dedicated SIDBI’s Stand Up India web portal at http://www.standupmitra.in/. Here the interested candidates can apply online for the loan under Stand Up India scheme. A self certification system will also be launched for the same purpose. The interested applicants can fill the online application forms by filling all the required data such as personal details, proposed business details etc. The applicants will be required to submit their plan of action along with the legal documents to validate their loan requirements. The online applications would be filled through

SC / ST / Women Entrepreneurs Eligibility Criteria for Stand Up India Loan Scheme

Government plans to reach out a maximum people and provide financial aid to start their businesses. But, it will not be feasible to provide loans to everyone. The applicants will be required to abide the rules and guidelines of the stand up India scheme. The designated team will review all the loan applications and approve only those showing true need and potential of success. Here is the complete eligibility criteria for SC / ST / Women Entrepreneurs to become eligible for Stand Up India Scheme:-

- SC / ST and/or women entrepreneurs above 18 years of age.

- Loans under Stand Up India Scheme is available for only green field project. Green field signifies, in this context, the first time venture of the beneficiary in the manufacturing or services or trading sector.

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC / ST and/ or women entrepreneur.

- Borrower should not be in default to any bank / financial institution.

Private Ltd Company / LLP eligibility criteria for Stand Up India scheme

- The company should be a private limited/LLP or a partnership firm.

- The age of the company/firm should not be more than 5 years.

- The annual turnover of the company should not exceed Rs. 25 Crore.

- A company dealing with commercial goods or innovating consumer products with approval from DIPP (Department of Industrial Policy & Promotion) will only be eligible for the loan.

- The company should also produce few more letters/documents at the time of application.

Size of Loan in Stand Up India Scheme

Composite loan of 75% of project cost inclusive of term loan and working capital. The stipulation of loan being expected to cover 75% of project cost would not apply if borrower’s contribution along with convergence support from any other schemes exceeds 25% of project cost.

Interest Rates Under Stand Up India Loan Scheme

The rate of interest would be lowest applicable rate of bank for that category (rating category) not to exceed (base rate MCLR + 3% + tenor premium). For sure, the loan under Stand Up India scheme will be provided at interest rate less than any other commercial loans provided by the financial institutions. The low interest rates charged to the borrowers will also help reduce the burden of paying back the loan amount. The interest rate may also depend upon the loan amount which vary between Rs 10 Lakh and 1 Crore.

Funding under the scheme

Initially, the central government of India has approved Rs. 10,000 Crores for the scheme. The funds will be allocated to the under privileged to encourage the innovative ideas.

Security / Repayment of Loans in Stand Up India Scheme

Besides primary security, the loan may be secured by collateral security or guarantee of Credit Guarantee Fund Scheme for Stand-up India Loans (CGFSIL) as decided by the banks.

The loan is repayable in 7 years with maximum moratorium period of 18 months.

Working Capital / Margin Money in Stand-Up India Scheme

For drawal of working capital upto Rs. 10 lakh, the same may be sanctioned by way of overdraft. Rupay debit card to be issued for the convenience of borrower. Working capital limit above Rs. 10 lakh to be sanctioned by way of Cash Credit Limit.

The Stand Up India Scheme envisages 25% margin money which can be provided in convergence with eligible central / state schemes. While such schemes can be drawn upon for availing admissible subsidies or for meeting margin money requirements, in all cases, the borrower shall be required to bring in minimum 10% of project cost as own contribution.

Key features of Stand Up India Loan Yojana

- The stand Up India initiative aims to support 2.5 lakh Women and SC/ST entrepreneurs to set up and grow their businesses.

- The scheme will provide 100% relaxation in income tax for startups for first 3 years.

- The loan application process and licensing process is to be automated for quick actions and faster approval.

- The government will launch dedicated website and application to help interested candidates.

- Financial aid amount for the startups will vary between Rs. 10 Lakh to 1 Crore.

- 80% rebate on the patent application fee will be refunded to the the entrepreneurs.

- The exit process only takes 90 days to wind up the entire process.

- The government has set a target sanction 2.5 lakh loans in a time frame of 36 months.

- More than 5 lakh schools across the country will be covered under the program to promote innovation core programs.

Credit and Finance for MSMEs in Standup India Scheme

The Modi government’s Standup India scheme has grown 21.3% in the number of loan applications sanctioned by lending institutions and 21.1% in the amount sanctioned in the past nearly 12 months. Stand Up India Loan Scheme facilitates loans to scheduled caste or scheduled tribe and women entrepreneurs for setting up greenfield enterprises. Launched on 5 April 2016, by Prime Minister Narendra Modi and subsequently extended up to 2025, the scheme has received 1,28,377 applications. Out of the received applications, around 1,10,813 applications involving Rs 24,803.85 crore were sanctioned so far, according to the Standup India data as of 10 February 2021.

Progress of Standup India Loan Scheme

The total number of loans extended till 10 March 2020 stood at 91,319 involving Rs 20,466.94 crore as per Ministry of Finance data. The Stand Up India Loan Scheme was launched to facilitate credit from Rs. 10 lakh to Rs. 1 crore to at least one SC/ST borrower and at least one woman borrower per bank branch of scheduled commercial banks for setting up their businesses in the manufacturing, services or trading sectors. The Stand Up India scheme has so far onboarded 327 lenders.

Till March 2020, the states with the highest number of accounts and amount sanctioned were Andhra Pradesh in which Rs 1,284.11 crore was sanctioned across 5,313 accounts. Similarly, 6,292 entrepreneurs in Gujarat secured Rs 1,837.7 crore in loan, Uttar Pradesh saw 11,455 entrepreneurs raising Rs 2,317.89 crore, Maharashtra had 6,834 accounts and Rs 1,577.05 crore sanctioned in loan.

Women are Biggest Beneficiaries of PM Stand Up India Scheme

Among the biggest beneficiary of the Standup India scheme were women entrepreneurs accounting for over 81 per cent of account holders as of February 17, 2020, according to the Ministry of Finance. Women entrepreneurs had 73,155 accounts for whom Rs 16712.72 crore was sanctioned and Rs 9106.13 crore was disbursed. Likewise, for the Pradhan Mantri Mudra Yojna (PMMY), women entrepreneurs cornered 70 per cent share of total borrowers.

Out of more than Rs 22.53 crore loans sanctioned till January 31, 2020, over Rs 15.75 crore loans were extended to women, according to the Finance Ministry statement last year. PMMY offers up to Rs 10 lakh loans to the non-corporate, non-farm small/micro enterprises classified as Mudra loans given by commercial banks, regional rural banks, small finance banks, microfinance institutions, and non-banking financial companies.

Benefits of Stand Up India Scheme

The stand up India loan scheme will benefit four kinds of individuals mainly angel investor, incubator, consultant and entrepreneurs. The scheme gives right platform to everyone and grow their businesses. Stand up India provides professional advice, time, and knowledge about laws to the angel investors and aid for initial two years of the first stage of the scheme. An incubator will get right coaching and expertise knowledge to shape their ideas and thoughts into a definite shape and structure.

The main benefit is for the loan borrowers, they need not to worry so much about paying back the loan amount. The borrowers will be given a time of up to 7 years to pay the loan amount. The loan borrower also have the freedom to choose the amount to be paid back per month.

Tax benefits under Stand Up India Scheme

The government will provide 80% rebate on patent filing fee under the scheme if the patent is filed by a startup. The scheme includes Credit Guarantee Fund and entrepreneurs need not to pay any income tax for the first 3 years. This will help startup grow at even faster pace without worrying about paying heavy taxes.

Check Stand Up India Scheme Guidelines through the link – https://www.standupmitra.in/Home/SchemeGuidelines

Helpline for Start up India

At present, there is no dedicate support team to help interested candidates regarding the scheme. However, more information about the initiative can be obtained by calling to concerned group at 011 40540722.

For more details, click the link – https://www.standupmitra.in/Home/SUISchemes

from सरकारी योजना

via

कोई टिप्पणी नहीं:

एक टिप्पणी भेजें

IF YOU HAVE ANY DOUBT PLEASE LET ME KNOW