MSME Udyam Registration Portal at udyamregistration.gov.in – Central government on 26 June 2020 notified new norms to allow Online Registration of New Enterprises based on self-declaration. From 1 July 2020, there is no requirement to upload documents and certificates for Udyam Registration. People can now Register New Enterprise Online with Aadhar Number and Self Declaration at udyamregistration.gov.in. The Union govt. has integrated Udyam Registration process with the Systems of Income Tax and GST. The filled in enterprise details can be easily verified on the basis of PAN number or GSTIN details.

An enterprise can be registered just on the basis of Aadhaar number. Other details can be given on self-declaration basis without any requirement of uploading or submitting any paper. Thus it is a paperless exercise in true sense. The notification also mentioned that after 1 July, an MSME will be known as “Udyam” as this is more closer to the word enterprise. Accordingly, the registration process will be known Udyam Registration.

From then onward, investment in Plant and Machinery or Equipment and Turnover are the basic criteria for classification of MSMEs. The notification also clarifies that exports of goods or services or both shall be excluded while calculating the turnover of any enterprise whether micro, small or medium.

Salient Features of MSME Udyam Registration

- Anyone may obtain the Udyam Registration for the enterprise. It can be registered through the portal i.e. https://ift.tt/3nU2BOd

- The process for Udyam Registration is fully digitalized and Paperless. There is no need to upload any document.

- Registration Process is totally free. No Costs or Fees are to be paid to anyone.

- An e-certificate, namely, “Udyam Registration Certificate” shall be issued online on completion of the registration process.

- This certificate has a dynamic QR Code from which the web page on our Portal and details about the enterprise can be accessed.

- Whoever intentionally misrepresents or attempts to suppress the self declared facts and figures appearing in the Udyam Registration or updation process shall be liable to such penalty as specified under section 27 of the Act.

- The online system is fully integrated with Income Tax and Goods and Services Tax Identification Number (GSTIN) systems, details on investment and turnover of enterprises are taken automatically from Government data bases. Exports are not taken as part of turnover calculation.

- Those who have EM-II or UAM authority under the Ministry of MSME, will have to re-register themselves.

- No enterprise shall file more than one Udyam Registration. However, any number of activities including manufacturing or service or both may be specified or added in one registration.

Requirement for Udyam Registration

- Only Aadhar Number is enough for registration.

- Having PAN & GST number is mandatory from 01.04.2021

Benefits of taking Udyam Registration

- It will be a permanent registration and basic identification number for an enterprise.

- MSME Registration is paperless and based on self-declaration.

- There will be no need for renewal of Registration.

- Any number of activities including manufacturing or service or both may be specified or added in one Registration. Along with the Udyam Registration, Enterprises may register themselves on GeM (Government e-Market place, a Portal for G to B) & Samadhaan Portal (a portal to address issues relating to delay in payments) and simultaneously MSMEs themselves can also onboard on TReDS Platform,(the invoices of receivables are traded on this platform) through three available platforms i.e. 1. www.invoicemart.com 2. www.m1xchange.com 3. www.rxil.in “.

- The Udyam Registration may also help MSMEs in availing the benefits of Schemes of Ministry of MSMEs such as Credit Guarantee Scheme, Public Procurement Policy, additional edge in Government Tenders & Protection against delayed payments etc.

- Becomes eligible for priority sector lending from banks.

Udyam Registration Online Portal – How to Apply Online

MSME Ministry had on 1 June 2020 notified new criteria for classification of MSMEs based on investment and turnover. Now on 26 June 2020, MSME Ministry issued detailed notification giving MSMEs classification criteria. The notification also clarified about the procedure for registration and the arrangements made by the ministry for facilitation in this process. The official website http://www.udyamregistration.gov.in/ has been started from 1 July 2020.

For New Entrepreneurs who are not Registered yet as MSME or those with EM-II

Below is the complete process for new entrepreneurs who are still not registered as MSMEs or those with EM-II to apply online for Udyam Registration:-

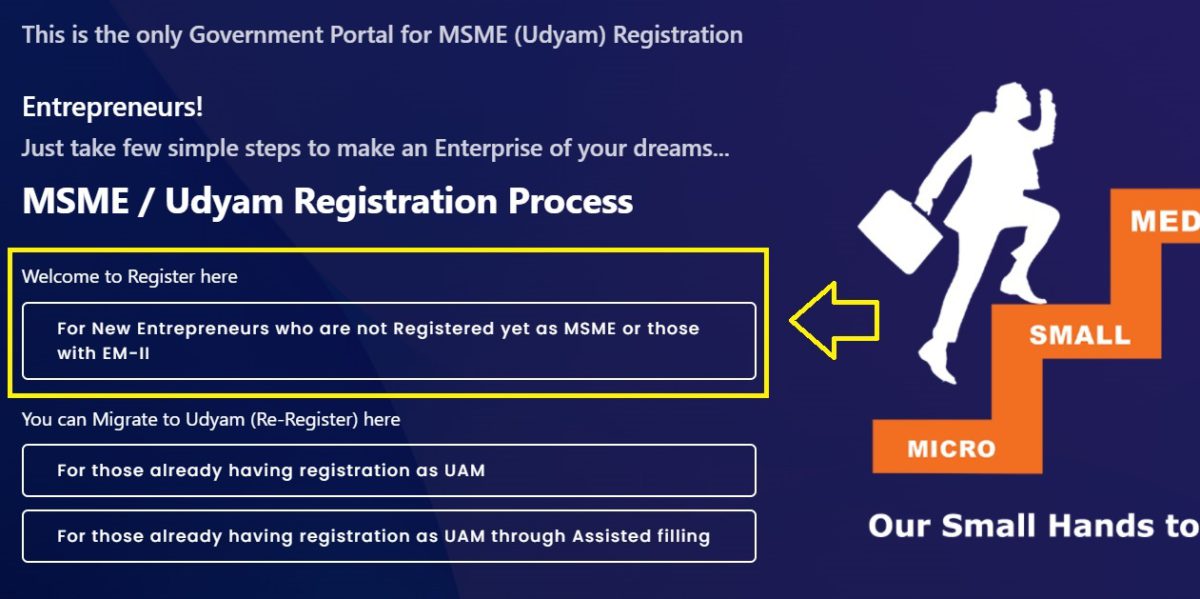

STEP 1: Firstly visit the official Udyam Registration Online Portal at https://udyamregistration.gov.in/

STEP 2: At the homepage, click at the “For New Entrepreneurs who are not Registered yet as MSME or those with EM-II” tab as shown below:-

STEP 3: Direct Link – https://udyamregistration.gov.in/UdyamRegistration.aspx

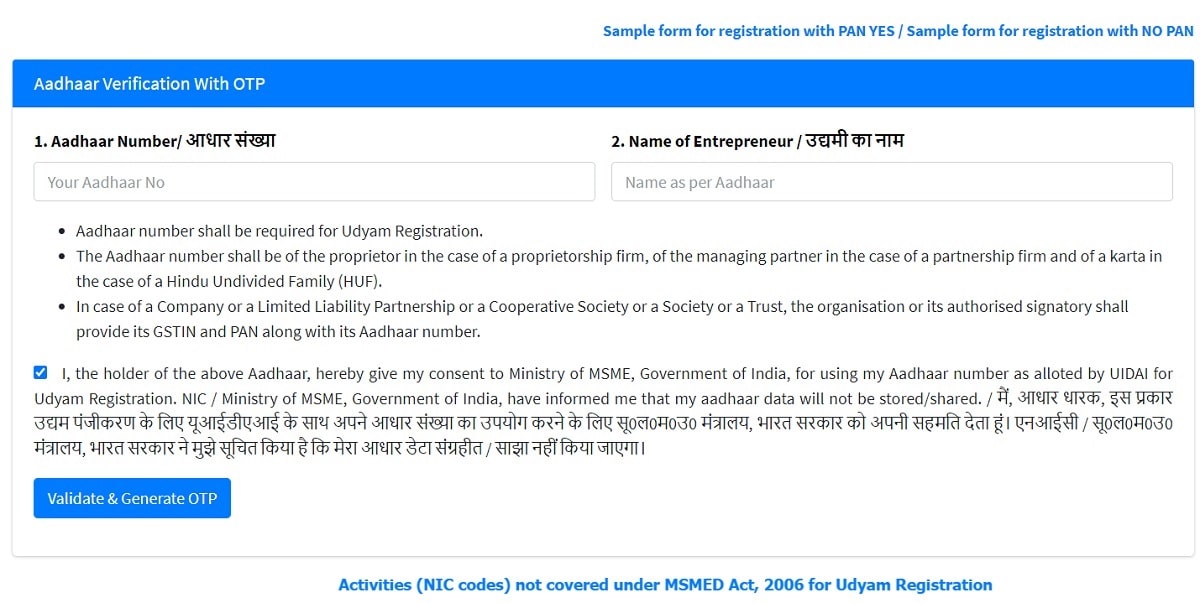

STEP 4: Upon clicking this link, the Udyam Registration Form For New Enterprise who are not Registered yet as MSME will open as shown below:-

STEP 5: Here applicants can enter the aadhaar number and name of the entrepreneur which is required for Udyam Registration.

STEP 6: An OTP would be sent on registered mobile number in aadhar card. Validate mobile number by entering OTP sent.

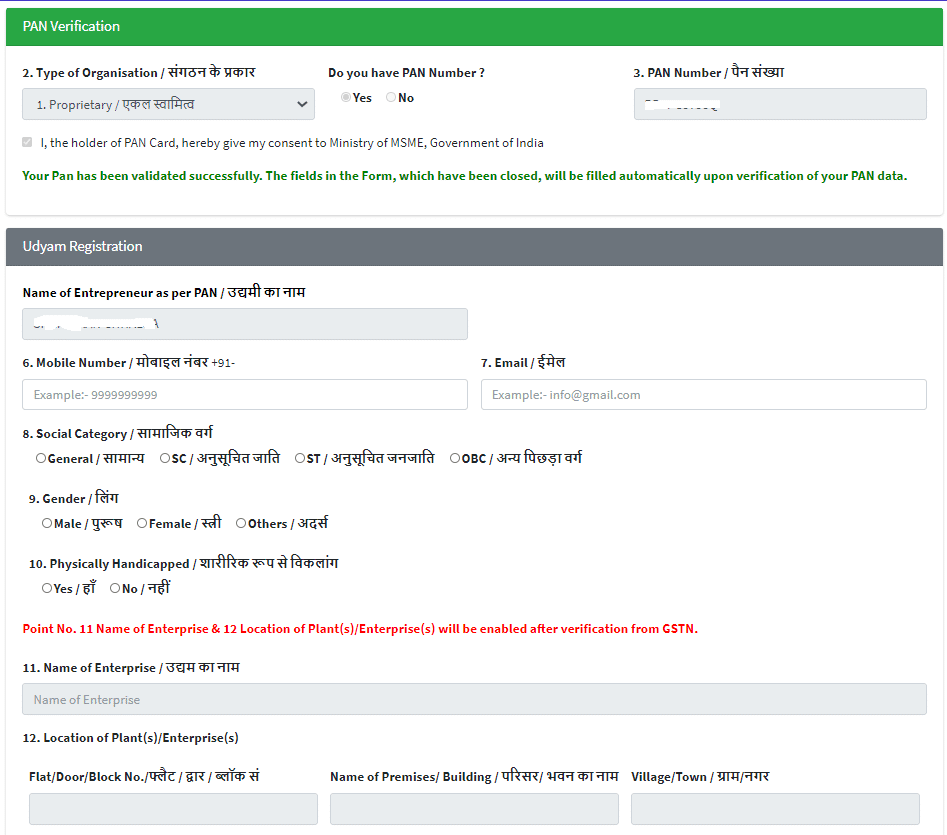

STEP 7: Afterwards, select type of organization, enter PAN number and validate PAN Card and fill in the remaining application form as shown below:-

STEP 8: Here applicants can fill in the remaining details in this form, submit it and make login to complete the Udyam apply process for New entrepreneurs.

Important Note – Aadhaar number shall be required for applying at the Udyam Registration Online Portal. The Aadhaar number shall be of the proprietor in the case of a proprietorship firm, of the managing partner in the case of a partnership firm and of a karta in the case of a Hindu Undivided Family (HUF). In case of a Company or a Limited Liability Partnership or a Cooperative Society or a Society or a Trust, the organisation or its authorised signatory shall provide its GSTIN and PAN along with its Aadhaar number.

Migrate to Udyam (Re-Register) for those already having registration as UAM

All existing enterprises registered under UAM shall register again on the Udyam Registration Online Portal after 1st July 2020. However, the existing enterprises registered prior to 30th June 2020 shall continue to be valid only for a period upto 31st March 2021. Below is the complete process to make Udyam Registration at Udyam Registration Online Portal for those who already have registration as UAM:-

STEP 1: Visit the same official website at https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

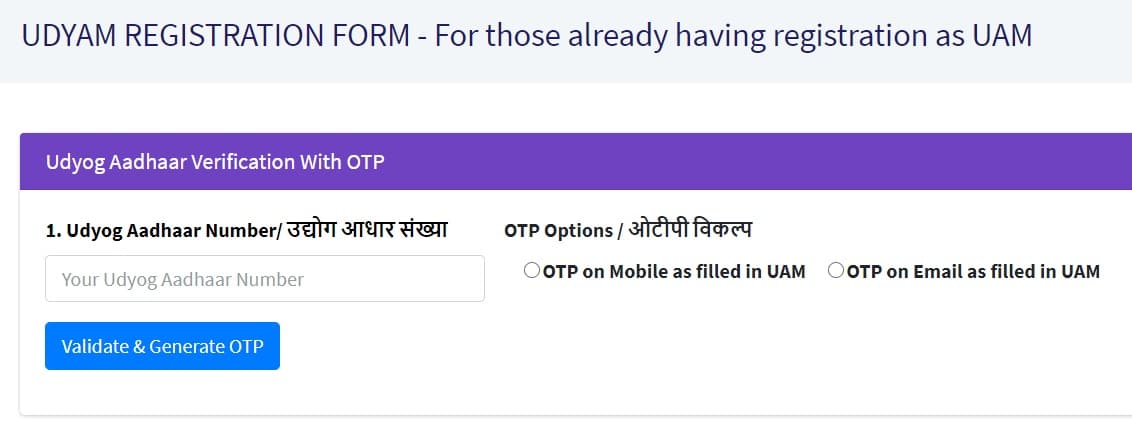

STEP 2: At the homepage, click at the “For those already having registration as UAM” link under ‘Migrate to Udyam (Re-Register) Here’ section.

STEP 3: Direct Link – https://udyamregistration.gov.in/UdyamRegistrationExist.aspx

STEP 4: Upon clicking this link, the Udyam Registration Form for existing entrepreneurs who already have registration as UAM will appear as shown below:-

STEP 5: Here applicants can enter their Udyog Aadhaar Number and validate OTP on Mobile / E-mail as filled in the application. Accordingly, fill in the remaining application form to complete the apply online process.

Furthermore, one enterprise shall be allowed to have only one Udyam Registration, wherein it may include any number of activities in the said registration at the Udyam Registration Online Portal.

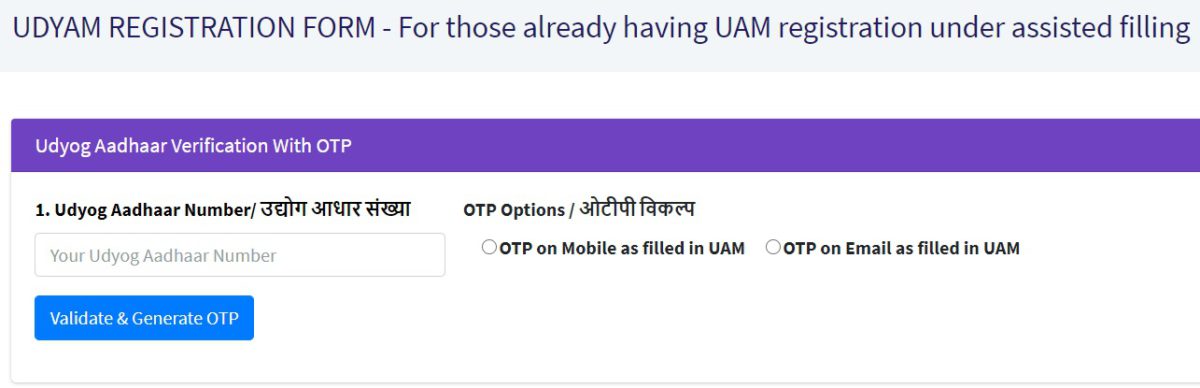

Udyam Registration Form for those already having UAM Registration under Assisted Filling

A) First of all, visit official Udyam Registration Online Portal at https://ift.tt/2KkKb7X

B) At homepage, click at the “For those already having registration as UAM through Assisted filling” link under “You can Migrate to Udyam (Re-Register) here” section.

C) Direct Link – https://udyamregistration.gov.in/Udyam_AssistedMigration.aspx

D) Upon clicking this link, the Udyam Registration Form for those already having UAM Registration under Assisted Filling will appear as shown below:-

E) Here applicants can enter the Udyog Aadhaar Number and select the OTP options such as OTP on Mobile as filled in UAM and OTP on E-mail as filled in UAM.

Then click at the Validate & Generate OTP button to perform the Udyog Aadhar Verification with OTP to complete the registration process at the Udyam Registration Online Portal.

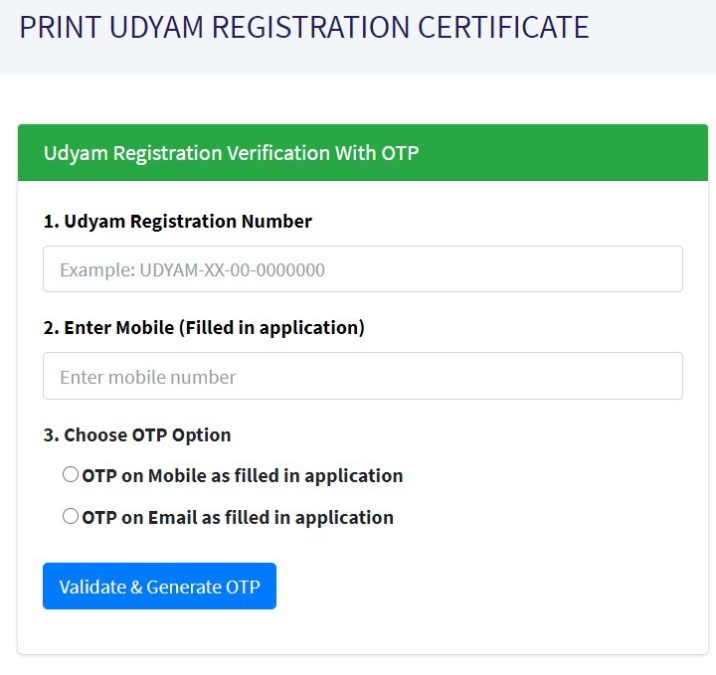

Udyam Registration Certificate Download / Print

All the applicants can now download / print Udyam Registration Certificate through the link given here – https://udyamregistration.gov.in/Print_msme_udyam_classification_registration_certificate.htm

The page to print / download Udyam Registration certificate at the udyam registration gov in portal will appear as below:-

Process to Download / Print Udyam Registration Certificate

At the page opened for downloading and printing the Udyam Registration Certificate, applicants will have to follow the process mentioned here:-

- Enter your Udyam Registration Number.

- Enter mobile as filled in the Udyam application.

- Choose any one option for OTP (One Time Password).

- After clicking on ‘Validate & Generate OTP’ button, you will receive OTP on Selected Option.

- Enter OTP and click on ‘Validate OTP & Print’ button. When your entred OTP matches succssfully, you will be auto redirect to Print Certificate.

Note : You are also informed that PAN and GSTIN are mandatory for Udyam Registration from 01.04.2021. You are advised to apply for PAN and GSTIN immediately and update the same on this website by 31.03.2021, to avoid suspension of Udyam Registration

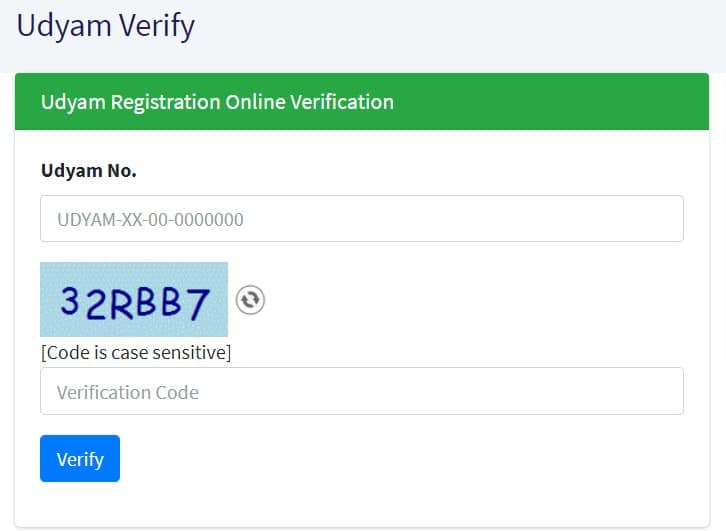

Verify Udyam Registration Number

All the applicants can verify their Udyam Registration Number through the direct link – https://udyamregistration.gov.in/Udyam_Verify.aspx

The page to verify Udyam Registration number at the udyam registration gov in portal will appear as below:-

Applicants will have to enter 19 digit Udyam No. (i.e. UDYAM-XX-00-0000000), enter Valid Verification Code as given in Captcha Image (note that verification code is case sensitive) and then click on the Verify Button.

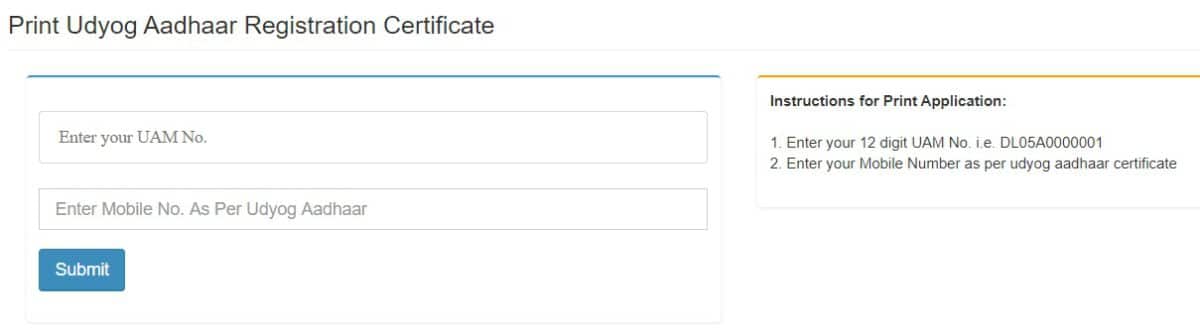

Print UAM Certificate / Check Application Status

Here are the direct links to print UAM certificate and print UAM application which are as below:-

Print UAM Certificate – https://udyamregistration.gov.in/UA/PrintAcknowledgement_Pub.aspx

Print UAM Application – https://udyamregistration.gov.in/UA/PrintApplication_Pub.aspx

Verify Udyog Aadhaar – https://udyamregistration.gov.in/UA/UA_VerifyUAM.aspx

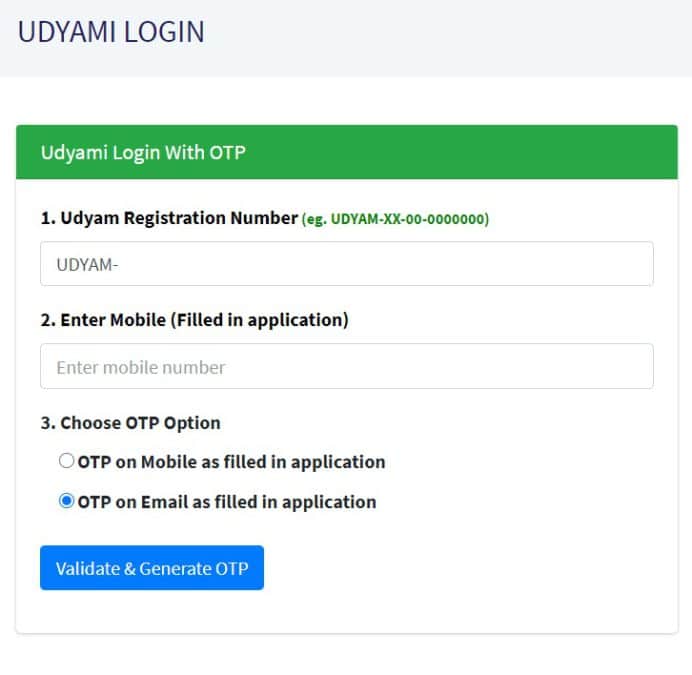

Udyami Login to Update / Cancel Udyam Registration

Udyami Login can be made easily at the official website udyamregistration.gov.in to update or cancel Udyam Registration. For this purpose, the direct link has been mentioned here – https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

Here enter your Udyam Registration Number, enter mobile as filled in the Udyam application. Then choose any one option for OTP (One Time Password). After clicking on ‘Validate & Generate OTP’ button, you will receive OTP on Selected Option. Finally, enter OTP and click on ‘Validate OTP & Login’ button.

MSME Ministry Facilitation Mechanism for Entrepreneurs

The MSME ministry has also established a strong facilitation mechanism for MSMEs in the form of Single Window Systems at the district level and regional level. This single window system of Udyam Registration Online Portal will help those entrepreneurs who are not able to file the Udyam Registration for any reason. At the district level, the District Industry Centres (DIC) have been made responsible for facilitating the entrepreneurs. Similar to this, MSME ministry’s recent initiative of Champions Control Rooms across the country have been made legally responsible for facilitating such Entrepreneurs in registration and even thereafter.

People who do not possess valid Aadhaar number can approach the Udyam Registration Online Portal for facilitation. Such people will have to carry their Aadhaar enrollment request or identity, bank photo passbook, voter ID card, passport or driving license with them. Accordingly, the Udyam Registration Online Portal will facilitate them in registering as enterprise after getting the adhaar number.

An enterprise having Udyam Registration Number (URN) shall update their information in the Udyam Registration Online Portal. It would include details of the ITR and the GST Return for the previous financial year and such other additional information as may be required on self- declaration basis. This is as per the notification in respect of updating of information and transition period.

New Definition of Micro, Medium, Small Enterprises (MSMEs)

MSME Minister vide its notification dated 26 June 2020 has notified certain criteria to classify micro, small and medium enterprises. Subsequently, notification also specified the form and procedure for filing the memorandum, for both new and existing enterprises with effect from 1st July 2020. The new definition of MSMEs will be as follows:-

- Micro Enterprise – The enterprise where the investment in plant and machinery or equipment does not exceed Rs. 1 crore and turnover does not exceed Rs. 5 crore will be considered as Micro Enterprise.

- Small Enterprise – The enterprise where the investment in plant and machinery or equipment does not exceed Rs. 10 crore and turnover does not exceed Rs. 50 crore will be considered as Small Enterprise.

- Medium Enterprise – The enterprise where the investment in plant and machinery or equipment does not exceed Rs. 50 crore and turnover does not exceed Rs. 250 crore will be considered as Medium Enterprise.

Calculation of Investment

The calculation of investment in plant and machinery or equipment will be based upon the Income Tax Return (ITR) of the previous year filed under the Income Tax (IT) Act, 1961. Moreover it is also clarified that plant and machinery will include all tangible assets other than land and building & furniture and fittings.

All units with Goods and Services Tax Identification Number (GSTIN) listed against the same Permanent Account Number (PAN) shall be collectively considered as one enterprise. These units will be used for the computation of turnover and investment for deciding the category as micro, small or medium enterprise.

Discrepancy / Complaint Redressal Mechanism

In case of any discrepancy or complaint, the General Manager of the District Industries Centre of the concerned District shall undertake an inquiry for verification of the details of Udyam Registration submitted by the enterprise. Afterwards, the official will forward the matter with necessary remarks to the Director or Commissioner or Industry Secretary concerned of the State Government. These officers will then issue a notice to the enterprise and after giving an opportunity to present its case and based on the findings, may amend the details or recommend to the MSME Ministry for cancellation of the Udyam Registration Certificate at the Udyam Registration Online Portal.

The new system of classification, registration and facilitation of MSMEs at Udyam Registration Online Portal will be an extremely simple and yet fast-track, seamless and globally benchmarked process and a revolutionary step towards Ease of Doing Business.

Read Full Notification at Udyam Registration Online Portal here – https://msme.gov.in/sites/default/files/IndianGazzate_0.pdf

from सरकारी योजना

via

कोई टिप्पणी नहीं:

एक टिप्पणी भेजें

IF YOU HAVE ANY DOUBT PLEASE LET ME KNOW