PNB Vyapaar Scheme Apply Online Form 2021: Punjab National Bank (PNB) has launched a new PNB Vyapaar Loan Scheme 2021 to provide loans to its customers. PNB Bank has issued a warning to the its customers about not taking loan from the informal sectors. The national bank has advised to seek financial assistance from formal sector and for that “PNB Vyapar” can be an option. The interested customers can get more details about PNB Vyapaar Scheme by logging in to the official website of PNB India at pnbindia.in.

What is PNB Vyapaar Loan Scheme 2021

Here we are going to tell you about the complete details of PNB Vyapaar Loan Scheme including objectives, eligibility criteria, loan limit, area of operation, margin, tenure, primary / collateral security, rate of interest and how to apply online for loans.

Objectives of PNB Vyapaar Scheme 2021

- For Working Capital facility (along with Non-fund based facility) for financing working capital needs of retail and wholesale traders, distributors/ agencies who deal in goods/ commodities (indigenous or imported). Advance is to be considered for genuine trade transactions and not to be utilised for hoarding/ speculative purposes.

- For financing traders for Purchase / Construction of Shop & Showroom / delivery van/ acquiring of assets for furnishing of Shop & Showroom like partition, fixture, furnishing, purchase of equipments like Air Conditioners, Refrigerators, other gadgets.

How to Apply Online for PNB Vyapaar Scheme

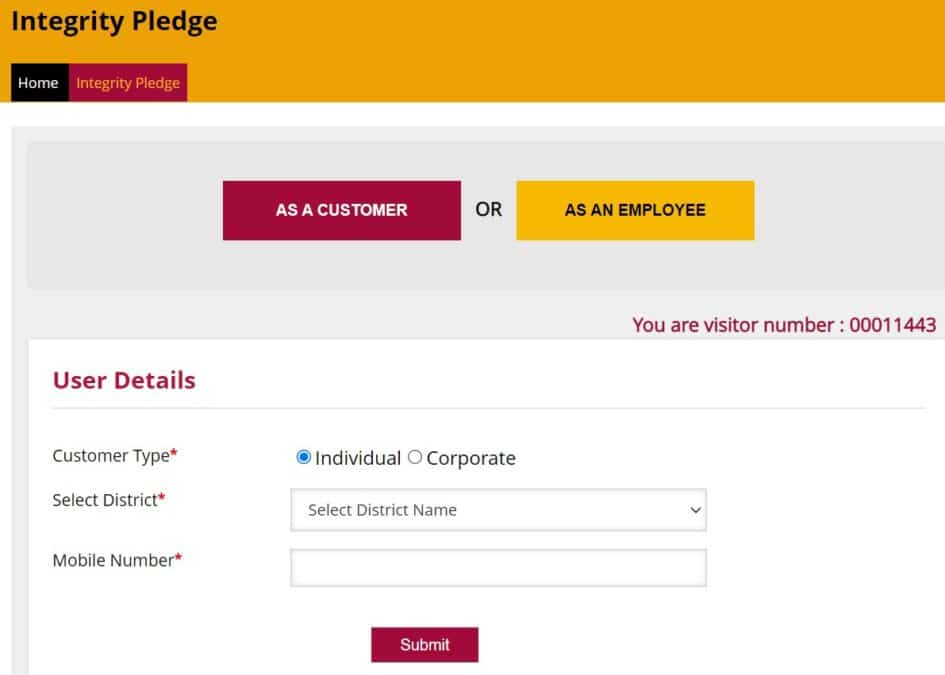

The direct link to apply online for PNB Vyapaar Scheme is https://www.pnbindia.in/pledge.aspx. On reaching this PNB India Integrity Pledge page, click at the “As a Customer” tab. Then the PNB Vyapaar Scheme online registration form will appear as shown below:-

Here select the customer type, district, mobile number and click at “Submit” button to fill PNB Vyapaar Scheme online registration form.

Eligibility Criteria for PNB Vyapaar Loan Scheme 2021

- Business entities which are individuals, firms, companies, Limited Liability Partnership (LLP), co-operative societies, dealing in business activities.

- Entities having valid Registration/ License, as applicable, under local laws (i.e. Shops & Establishments Act) obtained from appropriate authorities/GST Registration (wherever applicable) etc.

- Existing units should be a profit making one.

- New units may be allowed to avail the facility subject to compliance of security clause and other terms of scheme.

PNB Vyapaar Scheme Loan Limit / Area of Operation

All branches are eligible. The interested customers must note that the type of facilities available are – cash credit (fund based and non fund based) and term loan. The maximum amount of loan is given on the basis of need. For minimum amount, loans above ticket size of Rs. 10 lakh may be considered under this PNB Vyapaar Scheme.

PNB Vyapaar Loan Scheme Margin

For Term Loan

- Acquiring premises/land & constructions thereon on ownership basis required for running the business. In case of acquiring premises, 25% margin shall be ensured.

- In case of purchase of land, margin shall be 50% of the cost of land (including cost of registration). However, loan amount for the purchase of the land shall not be more than 50% of the total term loan amount sanctioned.

- Further, margin of 25% shall be ensured, in case of:-

- Financing for conversion lease hold business premises to free hold.

- For repair/ renovation/ furnishing of existing business premises/ showroom.

- To purchase furniture & fixtures for business premises

- To purchase new equipments/ business tools etc. for business

For Working Capital

- 25% on stocks

- 30% on Book Debts not older than 3 Months

- 40% on Book Debts more than 3 months and maximum upto 6 months.

- Cash margin for LC/BG – As per bank’s policy and delegation of power and changes from time to time.

Tenure of Loan under PNB Vyapar Scheme

Working Capital: Limit shall be renewed every year.

Term Loan: Upto 10 years inclusive of maximum moratorium period of upto 6 months. Interest during the moratorium period shall be serviced as and when due.

Primary Security under PNB Vyapar Loan Scheme

Hypothecation of assets created out of the Bank finance along with entire current assets and non-current assets (Present & Future) of the Unit. In case of financing immovable property for business premises mortgage of the same shall be taken.

Collateral Security for PNB Vyapaar Yojana

- Collateral security in shape of NSCs/KVPs/ FDR (at least 6 months old in case of fresh/enhancement/ additional facility), LIC (SV) / liquid security and/ or any other tangible security i.e. Equitable Mortgage of Immovable Property/ies (Other than Agricultural) having realizable value at least equivalent to the loan amount. In case of factory premises value of land and building (realization value) only be considered as collateral security.

- No additional collateral security is required, if the total loan amount is less than the value of purchase of Land & Building mortgaged with the Bank.

- Under any circumstances the loan shall not be considered for purchase of land only.

- Collateral is to be obtained when no CGTMSE/ CGSSI (Credit Guarantee Scheme for Standup India) cover is available.

- Under CGTMSE “Hybrid Security” product, collateral security for a part of the credit facility can be obtained whereas the remaining part of the credit facility up to a maximum of Rs. 100 lakh can be covered under Credit Guarantee Scheme of CGTMSE. Premium for Credit Guarantee schemes including renewal premium will be borne by the borrower.

Rate of Interest under PNB Vyapaar Loan Yojana

The PNB customers must note that the interest under PNB Vyapaar Loan Scheme will be as per the policy of the bank.

Download PNB Vyapaar Scheme PDF through the link – Click Here

MSME Schemes by PNB Bank – https://www.pnbindia.in/SMEBanking.html

For further details on PNB Vyapaar Loan Scheme, the interested customers can login to the official website of PNB at www.pnbindia.in

from सरकारी योजना

via

कोई टिप्पणी नहीं:

एक टिप्पणी भेजें

IF YOU HAVE ANY DOUBT PLEASE LET ME KNOW